Whenever you trade in the cryptocurrency market, you have to interact with the market by placing crypto trading orders. These orders are basic instructions to sell or buy any specific digital asset, whether bitcoin, Ethereum, or any other in a certain price range.

A cryptocurrency trade toolkit is based on different types of crypto trading orders. You can think of a crypto trade, just like exchanging different assets between a seller and buyer. Therefore, we used to call a crypto trade order instruction for exchanging assets, for example, bitcoin for any other digital asset, such as Ethereum or fiat currency, at a specific price.

Common crypto trading order types

Have you signed up for a cryptocurrency exchange and now wondering what all the different types of buttons do here? Don’t worry. Firstly, you need to learn different crypto trade orders to understand things better.

There are various crypto trading order types that exist that you must know in this regard. Let’s get to know about each of these below to understand things in the best possible way. So, here we go:

Market Order

A market order is a type of crypto trading order placed at the present market rate automatically for your preferred asset pair. When you want to place an order via Market order, the price is identified by the currently available rates on the order books.

An order book is just a list of the entire open orders available on a cryptocurrency exchange currently for a certain trading pair.

Essentially, an open order is any other investor ready to sell or buy an asset immediately at a certain price range.

How does a market order work?

A market order is an arrangement according to which you can sell or buy assets at the market’s current price immediately. In this order type, the market value is identified based on the best available price in the market when you are placing your crypto trade order.

- Restrictions can’t be placed on the execution of this type of crypto trading order. It is because the prices keep changing from time to time.

- Therefore, an estimated range of the total and fee is considered here instead of the asset’s true value.

- A trader executing a market order has to tell only the amount of assets they would prefer to buy or sell.

- The trader here can’t specify the asset’s price because it will be determined automatically using the current range of asset value available in the crypto market.

Once the trader has placed a market order, it will be executed automatically and continue to sell or buy a certain asset until the desired order amount entered for a trade is executed.

Limit Order

Even though the market order type is placed by a trader to sell or buy any asset at the current price immediately. However, a limit order is different entirely from this type of crypto trading order.

While a limit order is a process of selling or buying an asset at a specified price only. Such type of crypto trading order type is placed with the purpose to limit price risks.

How does Limit Order work?

Unlike Market orders, you have to put a precise limit on your Limit Order trade amount and price. If a trader wants to invest in bitcoin, but at a certain price only, the trader will opt for a limit order at that specific price for bitcoin.

For example, if the current BTC/EUR pair price is 9,000 EU, you have set the limit for this crypto order at 8,000 EU. It means your crypto trading order won’t execute immediately.

- Instead, the trade will be executed when the price of this pair will reach EU 8,000 or even better.

- Remember that if you have specified a higher limit price than the current price to buy or lower than the current price to sell, it can result in an instant fill.

- It is because there is a better price range is available than the specified limit price.

The major disadvantage of this type of trade order is that if any interested seller or buyer doesn’t meet the limit price within a specified time, your order won’t be filled. So, remember the fact that timing is an essential factor to consider when you are planning to place a limited order in the crypto market.

Stop-Limit or Stop Price Order

While the market order is meant to make a trade immediately at the current price range, and limit orders are placed to be filled at a price specified by the trader within a specific time frame. However, the third most common type of crypto trading order is called Stop-limit or Stop Price order.

It is an advanced crypto trading order type, which isn’t executed instantly. It is a combination of limit price and stops price specified by the trader who wants to sell or buy cryptocurrency. When the stop price reaches then the limit order is going to be placed at the limit price.

So, let’s move on to find that how this order will work in a good way.

How does a stop-limit order work?

A stop-limit order is a limit order created at a certain price. Once the specified stop price is reached, the order will turn into a limit order. For this, a trader has to specify a limit and stop price for his or her trade. This order type can be used to activate a limit buy or sell order when a stop-price (trigger) was activated by the market price.

This type of trading order neither appears in an order book nor reserves funds before these are activated.

For example:

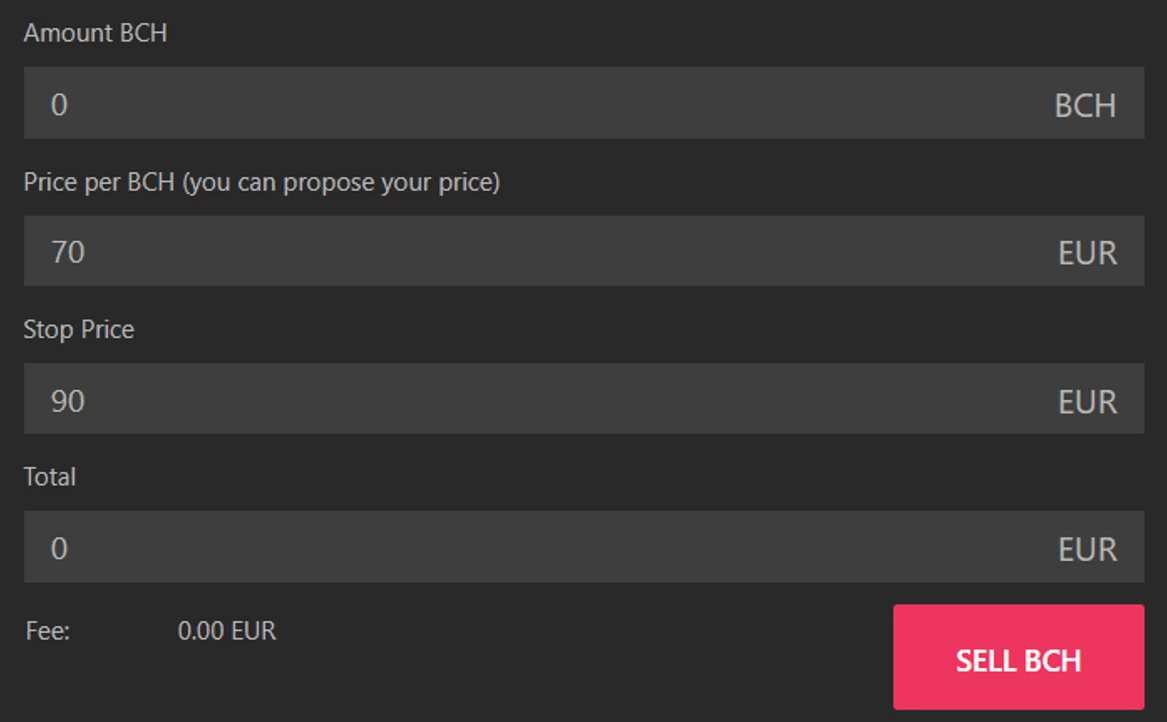

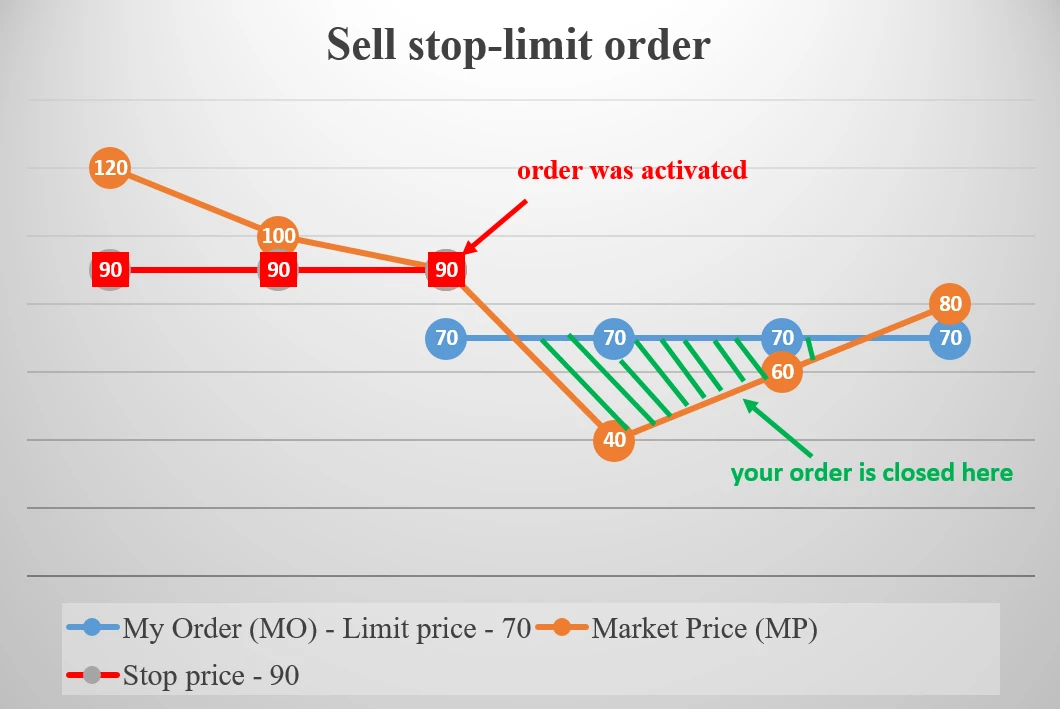

The Market Price (MP) is 120. You put a SELL stop-limit order with a limit price of 70 and a stop-price of 90.

Suddenly, the MP drops by 100, but your order is not still activated due to the stop-price (the trigger) was not reached.

Then, MP drops by 90 and reaches the stop-price, and meanwhile, your order becomes active and works as а Sell limit order, going to the Order book with the price of 70 (90 was just a trigger).

Let us see what happens when we put stop-limit BUY order:

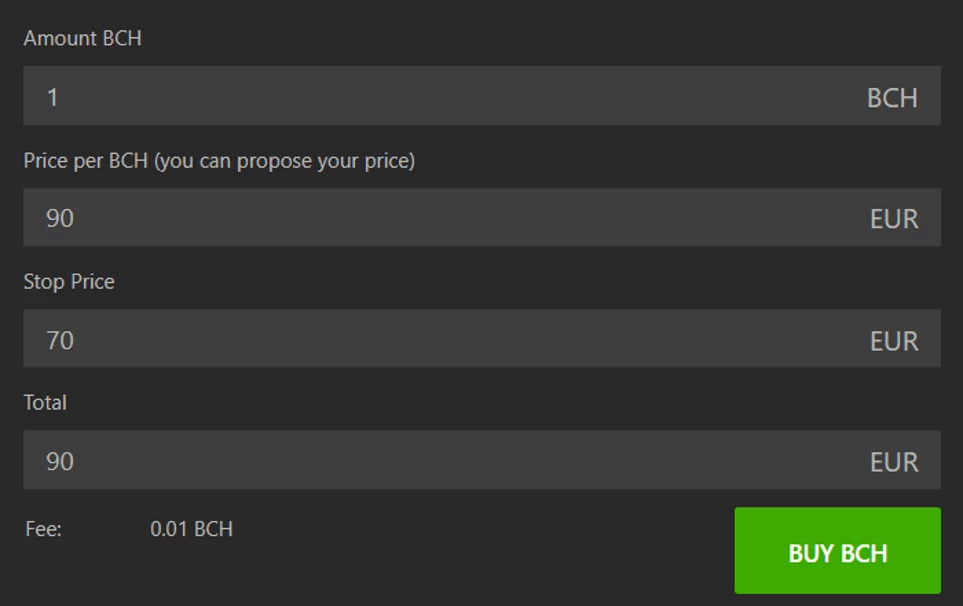

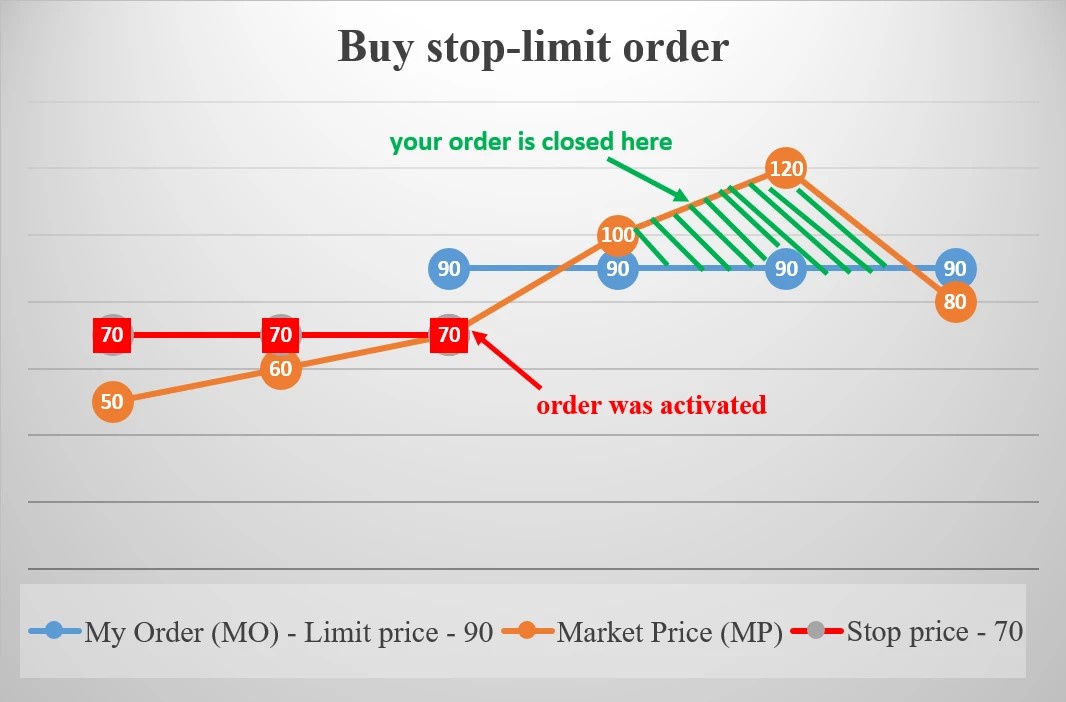

The Market Price (MP) is 50. You put a stop-limit BUY order with a limit price of 90 and a stop-price of 70.

Suddenly, the MP rises by 60, but your order is not still activated due to the stop-price (the trigger) was not reached.

Then, the MP rises by 70 and reaches stop-price meanwhile your order becomes active and is executed as a buy limit order, going to the Order book with the price 90 (70 was also a trigger in this case).

Final Remarks:

Knowing about different types of crypto trade orders is essential for good trading. Whether you want to go with a market order, limit order, or even stop-limit order, then you must be aware of the current trading tools available at present to plan for different outputs effectively.

However, here you have gotten to know about different types of crypto trading orders available. Knowing them will surely help you during your crypto trading process more effectively.