Although the United Kingdom is no longer a member of the European Union, it remains Europe’s largest concentration of crypto and blockchain companies. A significant share of UK-based crypto businesses serve EU customers, operate EU-facing platforms, or rely on European payment infrastructure.

This makes DAC8 directly relevant to the UK crypto ecosystem.

DAC8 is not a UK regulation. However, it introduces mandatory crypto-asset reporting across the EU, and it applies to any crypto-asset service provider that facilitates transactions for EU-resident customers — regardless of where the company is headquartered.

For UK-based crypto firms, DAC8 is therefore a cross-border compliance obligation, not a domestic one.

What Is DAC8?

DAC8 is the latest amendment to the EU Directive on Administrative Cooperation. Its purpose is to extend automatic tax information exchange to crypto-assets, following similar frameworks for bank accounts and financial instruments.

Under DAC8:

Crypto-asset service providers must collect tax-relevant customer data

Transaction data must be aggregated annually

Information is reported to a tax authority

Data is automatically exchanged between EU Member States

The framework is closely aligned with the OECD’s Crypto-Asset Reporting Framework (CARF), making it part of a broader global transparency trend.

Why DAC8 Applies to UK Crypto Businesses

DAC8 is activity-based, not location-based.

UK crypto businesses fall within scope if they:

Facilitate crypto transactions for EU tax residents

Provide crypto custody, brokerage, or exchange services to EU users

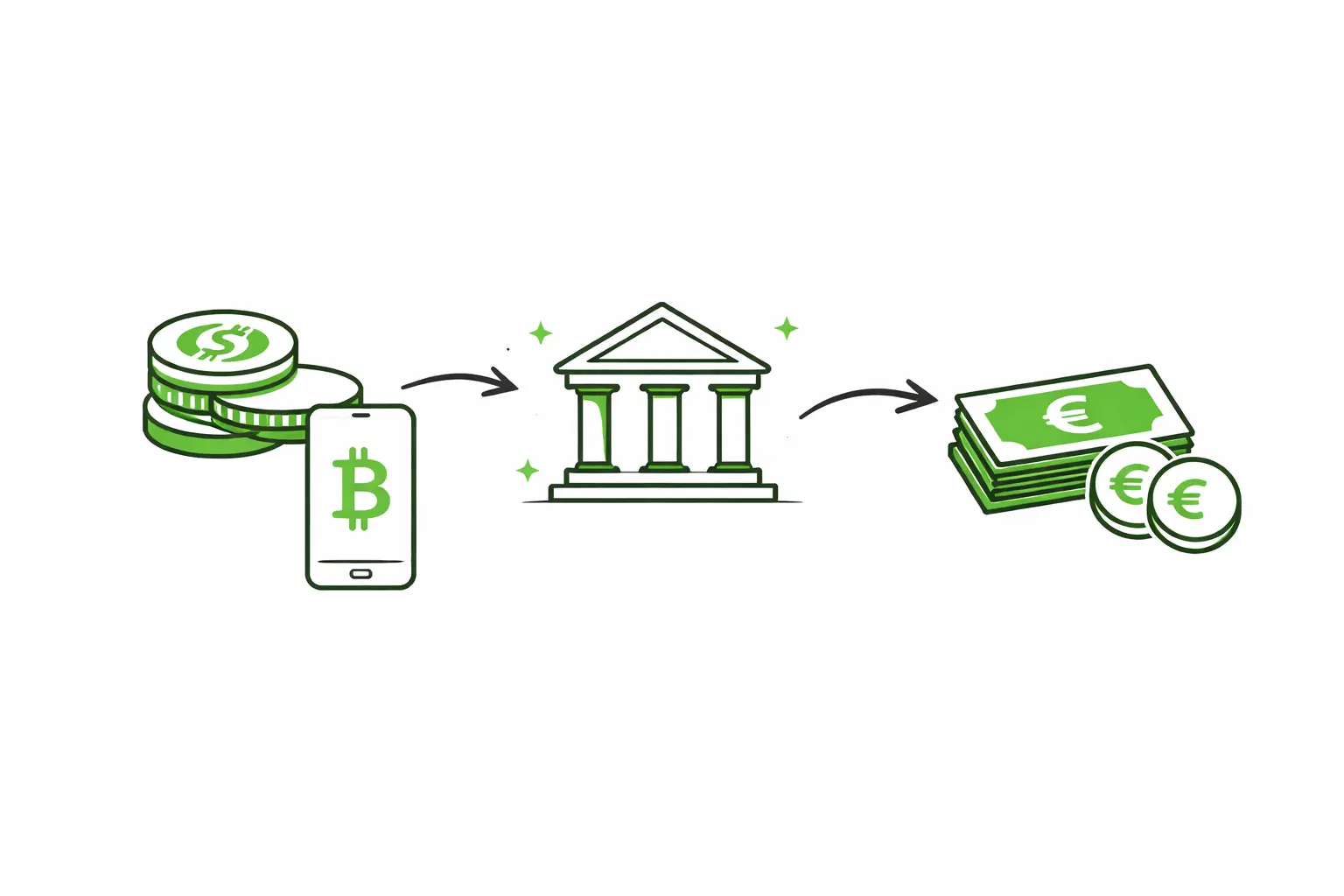

Enable crypto-to-fiat or fiat-to-crypto conversions involving EU customers

Operate platforms where crypto assets are transferred or settled

This means that many UK-based exchanges, payment providers, Web3 platforms, and fintechs will be considered reporting crypto-asset service providers under DAC8.

Reporting Structure: How UK Firms Will Be Caught by DAC8

UK companies will not report to HMRC under DAC8. Instead, reporting typically occurs:

Via an EU tax authority in a Member State where the firm is registered, operates, or has EU nexus

Or through an EU-based subsidiary or operational entity

The reported information is then shared across EU tax authorities automatically.

This creates a dual compliance environment for UK firms:

UK domestic obligations (AML, FCA registration, tax rules)

EU-level tax transparency obligations under DAC8

What Data Must Be Collected and Reported

DAC8 introduces extensive data requirements, including:

Customer Identification

Full legal name

Residential address

Date of birth (individuals)

Tax residence

Tax Identification Number (TIN)

Transaction Information

Type of crypto-asset

Total transaction volume per year

Transfers, exchanges, and disposals

Fiat inflows and outflows linked to crypto

For many UK firms, existing KYC processes will need to be expanded to capture tax-specific data, not just AML information.

Operational Impact on UK Crypto Firms

DAC8 is not a “reporting-only” issue. It has structural operational implications, especially for firms with scale.

Key impact areas include:

Onboarding workflows (tax residency verification)

Data architecture and transaction aggregation

Customer segmentation by jurisdiction

Reconciliation between crypto and euro payment flows

UK firms that rely heavily on EU payment rails, SEPA transfers, or euro settlement will need particularly robust data alignment.

Payments, Euro Accounts, and DAC8 Readiness

DAC8 reporting requires clean, traceable links between crypto activity and fiat movements.

This makes euro infrastructure strategically important:

Dedicated IBANs

Clear segregation of client and corporate funds

Consistent reconciliation between crypto ledgers and euro accounts

For many UK crypto businesses, euro payment infrastructure is already external to the UK — making structuring and documentation critical for DAC8 compliance.

Timeline for DAC8

By 31 December 2025: EU Member States transpose DAC8 into national law

From 1 January 2026: DAC8 obligations apply

2027: First reports covering the 2026 tax year

UK firms should treat 2024–2025 as the preparation window.

Common Risk Areas for UK Businesses

Missing or invalid EU TINs

Inconsistent residency classification

Fragmented data across multiple platforms

Poor linkage between crypto transactions and fiat settlements

DAC8 penalties will be determined at national level within the EU, making non-compliance a material business risk.

Conclusion: DAC8 as a Cross-Border Reality for the UK

For the United Kingdom’s crypto sector, DAC8 represents a shift from optional transparency to mandatory reporting when dealing with EU customers.

UK firms that prepare early — especially around data quality and euro payment structuring — will be far better positioned to operate smoothly in Europe post-2026.

Open a Monetum Account or Talk to an Expert to structure euro accounts, SEPA payment flows, and crypto-to-euro operations with DAC8 readiness in mind.