Stablecoins like USDC are increasingly used for B2B payments, treasury management, and global settlements. For businesses accepting crypto, the key operational question is simple:

How do you convert USDC to EUR efficiently and transfer funds via SEPA?

This guide explains how the crypto-to-euro off-ramp works, what infrastructure is required, and how businesses can reduce friction when moving from stablecoins to traditional banking rails.

Why Businesses Use USDC for Payments

Circle issues USDC, one of the largest dollar-backed stablecoins. It is widely used because:

- Transactions settle in minutes

- Fees are lower than traditional cross-border transfers

- It operates 24/7

- It avoids SWIFT delays

- It reduces currency volatility compared to other cryptocurrencies

Many SaaS platforms, trading firms, Web3 companies, and digital agencies now accept USDC instead of bank wires.

However, suppliers, payroll, and taxes still require euros.

That creates the need for a reliable crypto to euro conversion process.

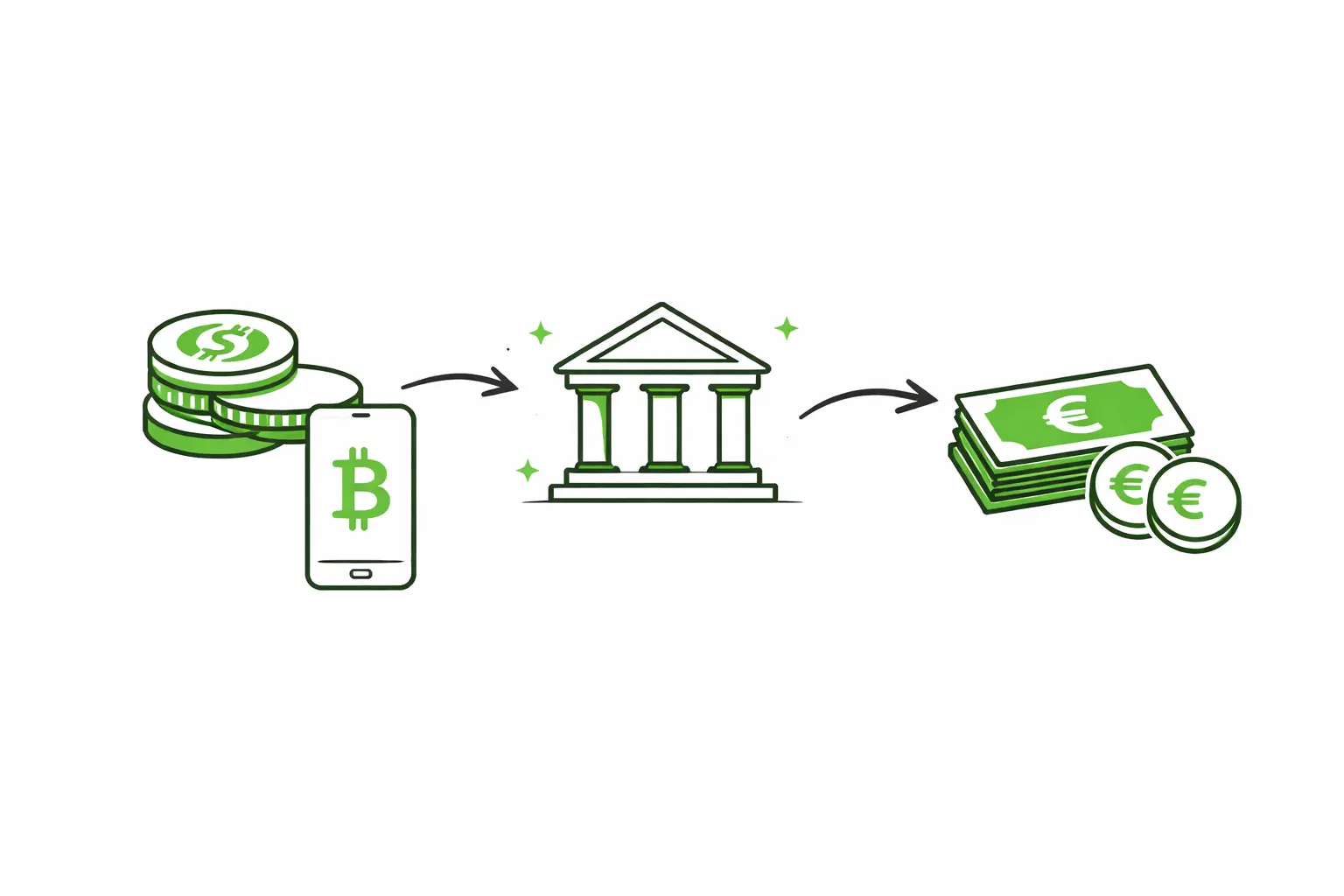

Step-by-Step: How to Convert USDC to EUR

Converting USDC to EUR typically involves three stages:

1️⃣ Receive USDC in a Secure Wallet

Businesses need either:

- A non-custodial wallet (where they control private keys)

- Or a custodial exchange wallet

With a non-custodial model, the company maintains full ownership of assets. This reduces counterparty risk compared to leaving funds on an exchange.

Monetum uses enterprise wallet infrastructure powered by Alchemy to enable secure, non-custodial wallet connections.

2️⃣ Swap USDC for EUR

Conversion can happen through:

- Centralized exchanges (CEX)

- Integrated crypto-fiat partners

- Direct API integrations

Monetum’s roadmap integrates conversion via Kraken, one of the most regulated global exchanges.

Estimated conversion structure:

- Near-instant execution

- Competitive ~1% fee (subject to confirmation)

- Deep liquidity for large business transactions

This step creates euros ready for transfer.

3️⃣ Transfer EUR via SEPA

Once converted:

- Funds move to a dedicated business IBAN

- SEPA transfers process across the eurozone

- SEPA Instant allows near real-time transfers

This final step is essential for operational liquidity.

Why SEPA Matters for Businesses

SEPA (Single Euro Payments Area) enables:

- Standardized euro transfers across 36 countries

- Reduced fees compared to SWIFT

- Faster settlement times

- Batch payments for payroll and supplier payouts

For companies converting USDC regularly, having a dedicated IBAN connected to crypto infrastructure reduces operational friction.

Custodial vs Non-Custodial in Crypto-to-Euro Off-Ramping

Many businesses face a structural choice:

Custodial | Non-Custodial |

Exchange controls private keys | Business controls private keys |

Higher counterparty risk | Reduced custody risk |

Faster onboarding | Stronger asset control |

Possible freezing | Direct ownership |

Recent exchange collapses have made custody risk a real treasury concern.

Monetum’s wallet structure is 100% non-custodial — meaning the business retains control over private keys at all times.

This provides:

- Asset sovereignty

- Reduced dependency on a single exchange

- Greater compliance flexibility

Key Compliance Considerations

Businesses converting crypto to euros must consider:

- KYC / KYB verification

- AML monitoring

- Source-of-funds transparency

- Stablecoin regulatory compliance

The European Central Bank and the European Union have implemented frameworks under MiCA to regulate stablecoins and crypto service providers.

Working with regulated infrastructure is now operationally critical.

Typical Use Cases

SaaS Platforms

Accept USDC from global clients → Convert to EUR → Pay vendors via SEPA.

Web3 Payroll

Receive stablecoins → Convert partially → Execute euro batch payouts.

Trading Firms

Realize crypto profits → Move liquidity to euro accounts → Reinvest.

Agencies

Invoice international clients in USDC → Convert to EUR → Cover operating costs.

Cost Comparison: Crypto vs Traditional Banking

Factor | Traditional Wire | USDC + SEPA |

Speed | 1–5 days | Minutes to hours |

Availability | Banking hours | 24/7 crypto rails |

Fees | SWIFT + FX spread | ~1% conversion + low SEPA fee |

Cross-border complexity | High | Lower |

For international businesses, the operational advantage is clear.

Why Businesses Need Integrated Infrastructure

The biggest friction in crypto-to-euro conversion is fragmentation:

- Wallet in one place

- Exchange in another

- Bank account elsewhere

Monetum combines:

- Non-custodial wallets

- Future integrated crypto ↔ euro conversion

- Dedicated IBAN

- SEPA transfers

- Batch payment capabilities

- API integration

All within one compliance-focused platform.

FAQs

Is USDC safe for business payments?

USDC is issued by Circle and backed by reserves, but businesses should still evaluate counterparty and regulatory risk.

How long does it take to convert USDC to EUR?

Crypto swaps can execute in minutes. SEPA transfers typically settle the same day or instantly via SEPA Instant.

Do I need an exchange account to convert USDC?

Typically yes, unless using an integrated platform that connects crypto wallets and fiat conversion services.

What fees apply when converting USDC to euros?

Conversion fees vary by provider. Many exchanges charge 1–2%. SEPA transfers usually carry minimal costs.

Can I keep funds non-custodial until conversion?

Yes. Non-custodial wallets allow you to retain control until the moment of exchange.

Final Thoughts

Stablecoins like USDC are becoming operational tools for global businesses. But without an efficient euro off-ramp, liquidity remains trapped on-chain.

A structured setup that combines:

- Non-custodial wallets

- Integrated crypto-to-euro conversion

- Dedicated IBAN accounts

- SEPA payment rails

is becoming standard infrastructure for modern digital companies.

Open your Monetum account today or Talk to an Expert to streamline your crypto-to-euro operations.