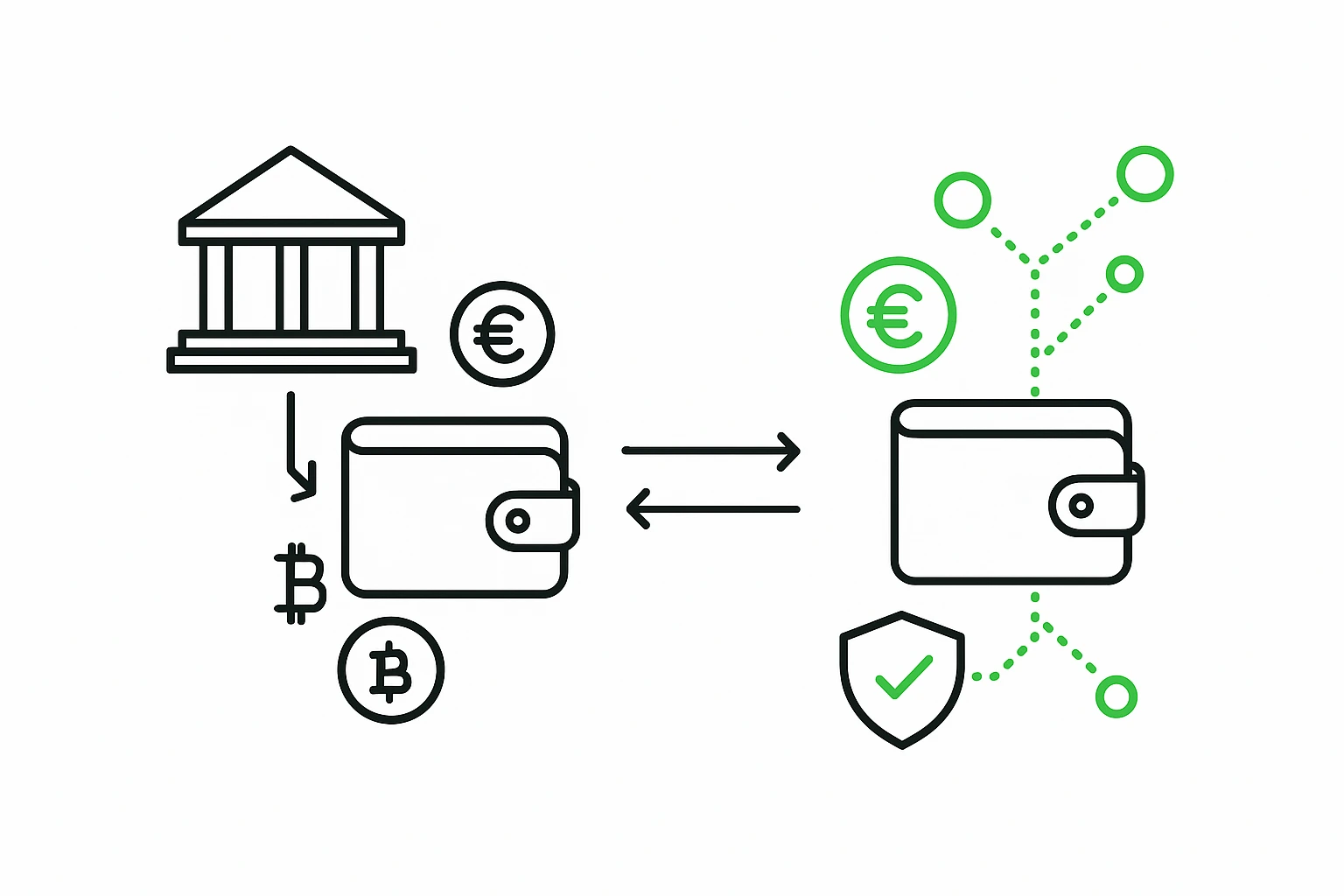

As digital assets enter mainstream business operations, the way companies store and manage crypto is becoming a strategic decision.

Should you rely on a third-party exchange, or hold your own keys?

This guide explains the difference between custodial and non-custodial wallets, compares major providers like Coinbase, Binance, and Fireblocks, and shows why Monetum’s non-custodial business wallet offers the right balance of control, security, and compliance.

What Is a Custodial Wallet?

A custodial wallet is managed by an intermediary—typically an exchange or service provider—that stores your private keys for you.

You can send and receive crypto, but the provider ultimately holds access to your assets.

Examples of custodial providers

Coinbase Exchange – U.S.-based and highly regulated, but users rely on Coinbase’s internal systems and KYC policies for access.

Binance – Offers convenience and multi-asset support, but user withdrawals can be temporarily frozen due to regional compliance reviews.

Kraken – Known for strong security, yet still holds user keys under a custodial structure.

Pros

Easy onboarding and recovery

Integrated trading and liquidity

24/7 platform support

Cons

Limited ownership — “Not your keys, not your crypto.”

Potential withdrawal limits or freezes

Counterparty and regulatory exposure

For individuals, this may be acceptable. For regulated or high-volume businesses, it can create operational risk and dependency on third parties.

What Is a Non-Custodial Wallet?

A non-custodial wallet gives you full control of your private keys—and therefore, your assets.

There’s no central authority between you and the blockchain.

Examples in the market

Metamask – Popular among Web3 users but designed for individuals, not businesses.

Ledger Enterprise – Offers hardware-based control but limited fiat integration.

Monetum Business Wallet – Combines enterprise non-custodial crypto storage with euro accounts, SEPA payments, and instant conversion.

Key benefits

You retain complete asset sovereignty.

Funds can’t be frozen by intermediaries.

Greater privacy and transparency for auditing.

A non-custodial setup means your company controls when, where, and how your assets move.

Monetum’s Approach: Full Control

Monetum’s non-custodial wallet is designed for B2B clients needing crypto functionality integrated with regulated financial infrastructure.

Unlike consumer-grade non-custodial apps, Monetum combines:

Swiss/EU regulatory alignment (FINMA-compliant environment)

SEPA-enabled euro accounts with dedicated IBANs

Crypto-to-Euro conversion via open-banking rails

Multi-user access controls for corporate teams

API connectivity for automated payouts and reconciliation

This gives businesses institutional autonomy without losing the safeguards of traditional finance.

Crypto Wallets Comparison Chart

| Provider | Custody Model | Crypto–Fiat Bridge | Compliance Jurisdiction | Designed For | Key Limitation |

|---|---|---|---|---|---|

| Coinbase Custody | Custodial | Limited to U.S. bank wires | U.S. (SEC/FinCEN) | Institutional investors | Full custody by Coinbase |

| Fireblocks | Semi-custodial MPC | Fiat via partner banks | Global (U.S./Israel) | Enterprises | Requires external fiat rails |

| Kraken Institutional | Custodial | Fiat conversions via exchange | U.S./EU | Trading firms | Assets held on exchange |

| Metamask / Ledger | Non-custodial | None (crypto-only) | N/A | Individuals | No fiat access |

| Monetum | Non-custodial | Integrated SEPA + crypto-to-euro off-ramp/ on-ramp | Switzerland | Companies & Enterprises | — |

Monetum uniquely combines self-custody with payment connectivity, giving businesses the flexibility of decentralized asset control with the reliability of Swiss financial infrastructure.

What’s important for Businesses

Operational Resilience: Avoid account freezes or downtime from custodial exchanges.

Speed: Process batch payments, settlements, and conversions instantly through SEPA Instant.

Transparency: Full on-chain traceability for compliance and audit purposes.

Global Reach: Accept crypto payments, hold assets securely, and off-ramp to euros without intermediaries.

In a market where over 40% of European businesses report banking restrictions on digital assets, non-custodial infrastructure provides the independence needed to stay competitive and compliant.

Frequently Asked Questions

1. What’s the main difference between a custodial and non-custodial wallet?

A custodial wallet is managed by a third party that holds your private keys. With a non-custodial wallet, you hold your own keys — meaning you have full ownership and access to your assets at all times.

2. Why should a business choose a non-custodial wallet over an exchange wallet?

Non-custodial wallets eliminate counterparty risk. Your funds can’t be frozen, restricted, or delayed due to exchange policies or compliance reviews. This autonomy is essential for companies managing daily crypto settlements or payouts.

3. Can Monetum’s non-custodial wallet handle both crypto and euros?

Yes. Monetum integrates non-custodial crypto management with SEPA euro accounts, allowing direct crypto-to-euro conversions and batch euro payments — all from one business dashboard.

4. How does Monetum ensure compliance while offering non-custodial services?

Monetum operates under Swiss regulatory frameworks (KYC/AML-compliant) and implements strict monitoring at the transaction layer — without ever taking custody of client funds.

5. How does Monetum compare to Fireblocks or Coinbase Custody?

Fireblocks and Coinbase are custodial or semi-custodial — they store your keys or share control. Monetum’s model is fully non-custodial, meaning your organization holds 100% of the keys while still accessing fiat rails and regulatory compliance.

6. Can non-custodial wallets support multiple users in a business environment?

Absolutely. Monetum supports role-based access control, allowing multiple users (e.g. finance officers, compliance managers, executives) to manage transactions under defined permissions.

7. Is a non-custodial wallet suitable for high-risk or crypto-intensive sectors?

Yes. Monetum is crypto-friendly and serves sectors often underserved by banks — including iGaming, Web3, trading platforms, and fintechs — with transparent compliance onboarding.

8. How long does onboarding take?

Most business accounts are verified within 24–48 hours after KYC/AML checks. Once approved, your team can immediately generate non-custodial wallets and begin transacting.

9. What’s the biggest advantage for businesses using Monetum?

Monetum delivers complete control, regulatory confidence, and financial efficiency — letting you manage crypto and euros seamlessly in one compliant ecosystem.

The Smart Choice for Crypto-Enabled Businesses

Monetum gives companies true ownership of their assets, with instant euro liquidity and regulatory assurance.

No intermediaries. No asset freezes. Just secure, compliant control.

→ Open a Monetum Account today and experience enterprise-grade non-custodial finance.

📞 Talk to a Monetum Expert and explore the best-fit solution for your company.